OK, let me start off with: I'm not in the finance sector. Yet I've seen so many wrong and misleading articles from so-called "technical specialists", "fi-tech advisors" or "tech analysts" in the recent months, I just have to rant about it.

Earlier this year, AMD has hit a low of below 2 bucks a share. Back in January, the share traded as low as $1.80.

Clearly one of the lowest points (not even a 52w-low, but still) in the stock history.

Nevertheless anyone in technology for more than 10 years knows that AMD is, besides Intel, the only x86 chip maker. What would happen, if AMD would go down? Intel would be the only x86 maker. That means: Market domination/monopoly.

In 1997 there was a similar case. Remember when Apple almost got broke? Well it received help from *drumrolls* Microsoft. Microsoft appeared as the savior of Apple but there was actually a lot at stake for Microsoft if Apple went out of business. To quote the article linked before:

But Microsoft, for its $150 million, gets something in return:

-- A shield from the heat of antitrust regulators. If Apple ceases operation, Microsoft has a 100 percent share of the personal-computer market.

"From Microsoft's standpoint, I think their interests are pretty much motivated by antitrust concerns," said Richard Scocozza, a software analyst at Brown Brothers Harriman. "It's in their best interest to keep Apple from failing so they don't incur any additional scrutiny from the Justice Department."

That's right. Everybody wants to be the market leader - but if there's no market anymore, big troubles (= regulations) arise.

See the similarities to Intel/AMD? So AMD cannot go down, not without having received financial help first. And this didn't happen either.

AMD sold their manufacturing branch and got some cash in, correct, but active financial aid (let's say from a government) was never received. AMD still had a pile of money from the good old 90's laying around to cover that. And even if there wasn't any money anymore, Intel would probably do the same as Microsoft did twenty years ago.

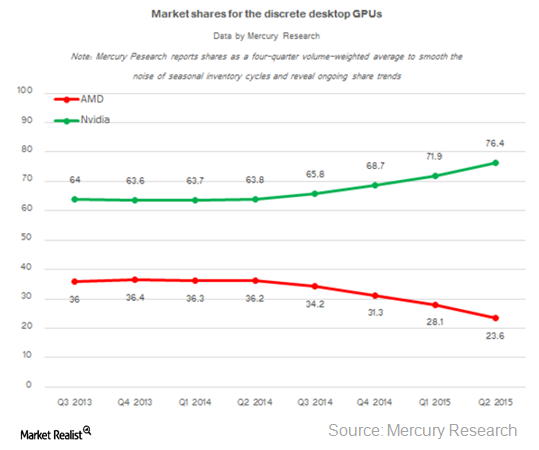

So far to the CPU market. In the graphics/GPU market, AMD clearly had a crappy few years and lost huge market shares to Nvidia. AMD, when it took over ATI, was probably the biggest and best known graphic card producer back then, but Nvidia came in with hyperspeed and eventually overlapped AMD.

2014-2015 it got even worse, when already leading Nvidia picked up speed and AMD lost once again:

Image source: http://marketrealist.com/2016/01/nvidia-snags-amds-share-gaming-market/

But AMD has learned from its mistakes or at least recognized that it cannot beat Intel in CPU chips anymore. So already in 2012, AMD decided to license ARM - the "alternative" CPU maker for mobile and embedded devices. And this was actually a crucial decision.

With this license, AMD was able to create chips with the mobile and power-effcient ARM technology. With the in depth knowledge of making x86 chips (CPU) and graphic cards (GPU), who'd be in a better position than AMD to create computing chips, cpu and gpu bundled together, with the new ARM technology? No one. And this is where AMD's healing point would start.

And then, something else happened: Virtual Reality or VR. I'm not a game fanatic, never was, but this is something which is going to change the world. Did you play ego-shooters (like Unreal Tournament)? Did you ever play Paintball? Now put those two together and you will see the possibilities of VR. I have no doubt, that in the near future (up to 10 years) we're going into "game halls", wearing VR goggles, running around with laser tag guns and seeing our allies and enemies in the game through the goggles. It doesn't matter if your team mate is playing along side with you, I mean standing in reality next to you, or not. Increasing Internet speeds will allow gaming remotely. Probably in game halls with the same shapes to reflect the maps of the game, but who knows with what they will come up. Anyway, the point is: Virtual Reality will come and it'll be big.

And what exactly is producing the in-game-experience? The goggles. This means: A very fast CPU and GPU running in the googles. And once again, who is able to put these two together in the best way? AMD. And this is where AMD's big-announced "Zen" technology comes in play. Massive CPU speed (comparable to Intel's rocket launcher Xenon), bundled together with a powerful GPU (this is known as an APU). That's not only for the classical gaming market something new, it will be a requirement for the new kind of VR-gaming.

So there are several reasons, why AMD will definitely not die. And even if they'd get out of cash, some intelligent investors would come to help because the potential of the emerging VR market is huge. Really huge (see Consumer Virtual Reality market worth $5.2 bn by 2018).

Yet, whenever I checked on the current share price on Google Finance, I saw disturbing news that AMD will go down, that AMD's shares are worthless etc. Let's pin those down:

1) Ashraf Eassa from The Motley Fool wrote in January 2014, that you better "Don't Buy AMD's ARM Server Story". Why? Reasons were given that

"ARM is disrupting x86 servers"

Which is true but aims at another target market

"ARM servers will offer choice"

So it's 2016 and what kind of ARM servers are available? Very few. What choice are we talking about here?

And another one:

"ARM is lower power"

Yes, of course, but consumes less energy. That's the whole point! It's perfect for small/embedded devices.

In January 2014 AMD first rose to over $4 but then fell to ~$3.40 to then rise to almost $3.90 again.

2) Leo Sun asked on The Motley Fool in January 2016 "Can Advanced Micro Devices Inc. Survive 2016?". Given the share price back then of under $2, it looked indeed pretty dark for AMD. The article correctly states that market share fell against AMD's competitors. But once again, AMD is only compared against Intel and Nvidia. The ARM stategy of embedded devices is only stated with:

Instead of competing more aggressively against Intel and Nvidia, AMD has been counting on its EESC (Enterprise, Embedded, and Semi-Custom) unit to offset those losses. That division produces SoCs for gaming consoles, servers, and other embedded devices. Unfortunately, revenue at that unit fell 15% annually to $488 million last quarter, while its operating income plummeted 46% to $59 million. AMD's guidance indicates that growth likely won't bounce back unless console sales accelerate -- which could be tough considering that the PS4 and Xbox One are already over two years old.

Instead of seeing the embedded market as AMD's chance of rising again, the analyst suggested to attack Intel once more:

Looking ahead, AMD's best hope is to play offense against Intel with its new Zen x86 processors

No word of the emerging VR market, however a correct response to the question in the title of the article:

However, AMD likely won't go bankrupt in 2016. The company's cash and equivalents dipped just 2.5% annually to $785 million last quarter, and its total debt only rose 2.3% to $2.26 billion. No new debt should come due until 2019. [...] Therefore, the real question investors should ask isn't if AMD can survive 2016, but whether it will still be around in 2020.

3) In April 2016, Chris Neiger wrote on The Motley Fool the article "NVIDIA vs. AMD: Which Is the Better Buy?" and came to the conclusion:

"Both companies clearly have their strong suits, but I think NVIDIA is a better buy right now because of the new market segments it's pursuing. There are projected to be 12 million driverless car sales annually by 2035, according to IHS Automotive, and NVIDIA's technology is helping to push that market forward in ways AMD just can't match. Similarly, VR's growth over the coming years should bring in additional revenue for both companies, but NVIDIA's dominant position in GPU market share gives it the clear advantage in the space. AMD may be expanding further into servers and PC processors, but just as Intel has shown, betting on the PC market is a losing battle. I think NVIDIA's pursuits have better long-term potential, and that's why I'd choose it right now."

So first of all: Nvidia has much more to lose in the GPU market. As it already has a high market share, it's more likely this share will go down than up.

Second of all: The article talks about potential driverless cars - in 2035! We will see VR before that.

Third point: He's absolutely right that VR's growth will be a booster. But here again comes AMD with its CPU+GPU bundle experience plus the licensed ARM technology. Pole position at least.

And lastly: The author is putting into the "classic" role to compete against Intel again. Sorry mate, AMD already knew when they obtained the ARM license, that the pure CPU game against Intel is over.

Note that in April 2016, AMD shares umped from ~$2.60 to ~$3.60:

4) Timothy Green from The Motley Fool wrote on Jun 22nd 2016 "3 Reasons Advanced Micro Devices Inc. Stock Could Fall". This is probably THE article which stuck in my head and which led me to write this rant. There are so many personal opinions in this article, none with technical proof or sight as:

"This kind of optimism can be dangerous, especially given AMD's history of failing to deliver on its promises."

NVIDIA's unit share of the graphics card market stands at about 80%, up from 60% in early 2014. [...] If AMD doesn't produce the kind of market share gains investors seem to be expecting, the stock could lose some of its recent luster.

"With a current market capitalization of around $4 billion, buying AMD at this price requires the belief that AMD is not only going to surge back to profitability, but that the company is going to be fundamentally different than it has been in the past. The stock price may have gotten out ahead of what AMD can realistically accomplish, and any bad news at all could send shares lower."

The article itself has a lot of "could" in it, but the title itself got on my nerves. If you only read the title, you assume that AMD will fall and you have to short the stock. When the author mentioned "buying AMD at this price..." (which was at that day on June 22nd 2016 at $5) "... requires the belief that AMD is not only going to surge back to profitability...", well, guess what happened right in that quarter, ending on June 25th 2016? AMD went back into profitability with a net income of 69 million. Not a lot, but considering the constant net loss in the previous years, a big win back to success.

The article also doesn't mention VR, not even once.

It's worth to note here where AMD actually made profit (although numbers for that quarter were only released one month later, on July 21st 2016). The official AMD press release for Q2 2016 states:

Enterprise, Embedded and Semi-Custom segment revenue of $592 million increased 59 percent sequentially and increased 5 percent year-over-year due to higher sales of semi-custom SoCs.

Note that the stock price of AMD was meanwhile at $5, yet the article suggested that the share will drop.

Meanwhile, at the time of this writing on September 2nd and 4th 2016, the share price is at $7.51. An increase of ~170% given the share price of $2.77 on January 4th 2016 and now the current share price. If you read and believed in these articles, you missed a great opportunity and a "safe" gainer.

There were a lot more of these negative articles, I just picked some which I read at that time and which stuck in my head. Also Seeking Alpha, another financial analyst blog, had quite a lot of negative AMD news - however the articles from The Motley Fool caught my eye as they were almost always negative about AMD. Why's that? Actually after every article published on The Motley Fool, there's a disclaimer attached. Interestingly this shows, that:

The Motley Fool recommends Intel and Nvidia.

And why do they recommend Intel and Nvidia? The disclaimer on an older article (the one I quoted from January 2014) shows:

Ashraf Eassa owns shares of Intel. The Motley Fool recommends Intel. The Motley Fool owns shares of Intel.

So all these articles with a negative touch are purely motivated by The Motley Fool's own interests, instead of reporting independently and therefore being a "real" source of advise for investors. If the shares of AMD's competitors go up, The Motley Fool wins. Clever, to say at least.

Everybody who bet against these articles, follow his own gut and most importantly being able to count one and one together, me included, won. It's going to be interesting to see whether the articles will turn positive in case The Motley Fool suddenly owns shares of AMD themselves.

To finish this rant, let me do it, as these so-called fi-tech analysts are doing it:

I give AMD a strong buy, given the current bullish performing. In the short term (now YTD) I expect AMD to reach $9. In the longterm, given VR hits the main markets and AMD continues with success in sales, technology and also reports more steady results (=profits), I expect AMD to hit $15 until or before 2018.

Don't take my word for it though, because I'm not a financial advisor/analyst ;-).

No comments yet.

AWS Android Ansible Apache Apple Atlassian BSD Backup Bash Bluecoat CMS Chef Cloud Coding Consul Containers CouchDB DB DNS Databases Docker ELK Elasticsearch Filebeat FreeBSD Galera Git GlusterFS Grafana Graphics HAProxy HTML Hacks Hardware Icinga Influx Internet Java KVM Kibana Kodi Kubernetes LVM LXC Linux Logstash Mac Macintosh Mail MariaDB Minio MongoDB Monitoring Multimedia MySQL NFS Nagios Network Nginx OSSEC OTRS Observability Office OpenSearch PHP Perl Personal PostgreSQL PowerDNS Proxmox Proxy Python Rancher Rant Redis Roundcube SSL Samba Seafile Security Shell SmartOS Solaris Surveillance Systemd TLS Tomcat Ubuntu Unix VMware Varnish Virtualization Windows Wireless Wordpress Wyse ZFS Zoneminder